stock sell off meaning

Despite these sell-offs the annual return of the index was positive in 31 out of 41 years. A sudden and marked decline in stock or bond prices resulting from widespread selling.

How To Analyze And Improve Current Ratio Financial Analysis Financial Management Accounting And Finance

To begin with understand that sell.

. The Nasdaq Composite is down nearly 8 and today we could see another 2 sell-off. Insiders can be wrong and going solely off of insider selling means you may miss the broader context. Following poor group results the chain sold off some of its less profitable stores.

A period of heavy selling as on a stock exchange resulting in a marked decline in prices. To sell off things left in stock is to get rid of them usually by selling them at very low prices. Stocks officially entered a.

Sell-off definition a sudden and marked decline in stock or bond prices resulting from widespread selling. Its a law of the market. What does sell-off mean.

A sell-off is the rapid selling of a security leading to a sharp decline in its price. You made a small profit off the sale and youre happy with that but then you see that XYZs current price is 45. Tesla fell more than 9 giving up some of the gains it made ahead of its recent stock split.

There are myriad reasons why one of these entities may fail and cause a run on those. After A Big Sell-Off A Low-Volume Rebound Means Its Time To Sell Stocks. This particular 5 sell-off in the SP 500 is the 27th one since March 2009.

This means that the Nasdaq will officially enter. Decide whether youre a trader or investor. So recognizing those signals is.

Sell-Off Period means the period from the Closing Date until the later of i the date at which Purchaser has sold all of the Inventory that consists of LEUKINE and ii the date which is three months after the date the FDA has approved Purchasers new packaging displays signs promotional materials manuals and forms for use in the packaging marketing promoting. You check in your portfolio the next Monday and find that your limit order has executed. This comes down to how long you plan on holding onto your stock.

A market sell-off can occur in any traded asset and may vary in scope. Notably last year was quite abnormal in that the largest. What is a Sell-Off.

Apple also split this week and it lost 8. Based on the market breadth data price volume analysis and the Point and Figure price target prediction for SP 500 it seems like the sell-off is not. Generally speaking prospective buyers sit on the sidelines until the conditions that caused the sell-off to occur are over.

Instead it is a loose term referring to a period when investors are far more eager to sell than to buy. The meaning of SELL-OFF is a usually sudden sharp decline in security prices accompanied by increased volume of trading. Insiders often have better insight into a company than the average person.

A massive sell-off can also occur in the bonds of an individual company city or state. Ultimately it is essential to refer back to the price action of SP 500 and its characteristics to confirm the price movement. Tracking insider selling isnt a perfect method.

While it is usually a difficult period for investors traders are relatively immune since they can make money when stocks are moving in either direction. When a substantial number of shareholders sell a specific stock it is called a sell-off. Even the best stocks eventually start to waver and break down.

But experts agree that selling when the market falls can hurt your long-term financial health. How to Sell Stocks. They can encompass an entire market at once.

Here are 10 things you should know about this recent stock market sell-off. A broad stock sell-off is a perfect time to pick up shares of great companies that will later boost your portfolio. An act or instance of liquidating assets or subsidiaries.

How to use sell-off in a sentence. How Does a Sell-Off Work. During whats called a sell-off a short period of time during which a high volume of securities are sold causing a price drop it can be tempting to sell your investments as well.

Tracking insider selling could indicate when to buy or sell a stock. Copyright 2005 1997 1991 by Random House Inc. Looking back at the average calendar year back to 1980 the SP 500 has experienced a 14 peak-to-trough decline.

A stock market sell-off is a period when the overall stock market drops. For example suppose you enter a 30 sell limit order on XYZ stock before taking a week off for vacation. 193540 Random House Kernerman Websters College Dictionary 2010 K Dictionaries Ltd.

It does not mean the price must come down to the price target. They also make more. When they renew their range annually they sell off their end-of-line stock.

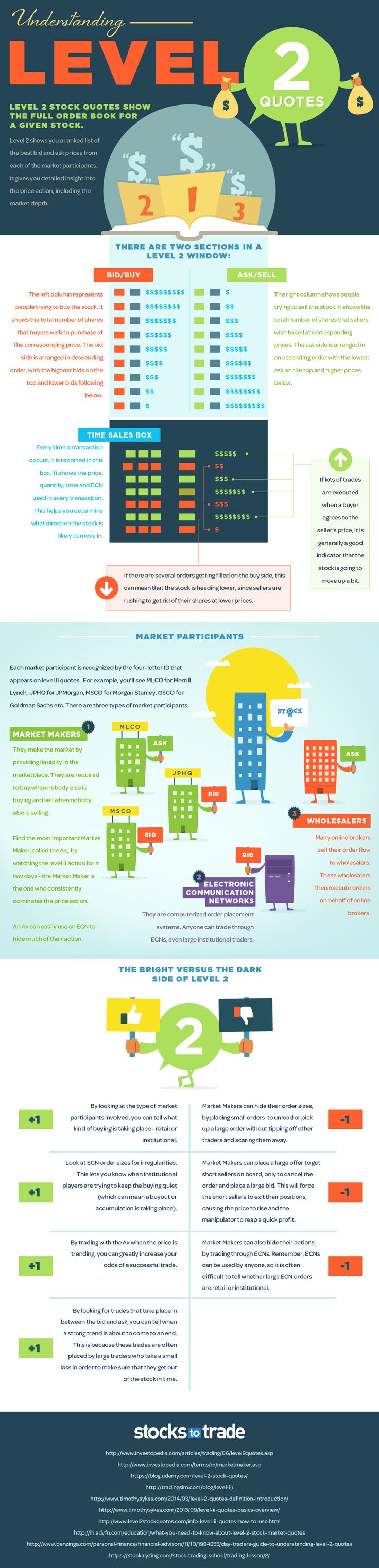

Understanding Level 2 Quotes Infographic Infographic Online Broker Things To Sell

:max_bytes(150000):strip_icc()/WhatisPanicSellingandHowtoProfitFromIt2_2-31205676395a4eb5a6b6d5e857eb4b50.png)

What Is Panic Selling And How To Profit From It

Motivation Opportunity Moneyman Moneyquotes Cash Surveymoney Dollars Entrepreneur Makemoney Makemoneyathome Online Investing Cryptocurrency Fiat Money

How To Overcome Your Fear Of The Bear Market Dr Breathe Easy Finance Bear Market Stock Market Stock Market For Beginners

What Is Cross Selling Examples Of Cross And Up Selling In 2021 Cross Selling Selling Strategies Earn More Money

Currency Arbitrage Meaning Types Risk And More Accounting And Finance Financial Management Business Entrepreneur Startups

Tap The Image To Learn More Follow Us Forex Trading Strategies Day Trading Stocks Trading Pins Pin Trading Day Trading For Beginners Trading Options Trading St

Retirement Selling Weekly Covered Calls On Apple Stock Nasdaq Aapl Seeking Alpha Nasdaq Apple Stock Covered Calls

Secured Vs Unsecured Bonds All You Need To Know Financial Management Good Credit Bond

What You Need To Know Aboutcyclical Stock As A Beginner In 2022 Finance Personal Finance Meant To Be

Secrets Op Twitter 3 When Altseason Don T Focus On A Date But Understand Money Flow Duration Of The Phases Are Par Smart Money Things To Sell How To Plan

Mean Renko Bars Indicator Mt4 Intraday Trading Free Neon Signs

The Value Of A Business Is The Amount Of Money It Will Sell For If Someone Decides To Buy All Of It In A Good Investing Strategy Investment Quotes Stock Market

Today S Definition Market Is Up A Common Phrase Meaning The Stock Market Or A Major Market I Psychology Terms Employee Stock Ownership Plan Things To Sell

:max_bytes(150000):strip_icc()/dotdash_INV-final-Sell-Signal-Apr-2021-01-a114b66c6dbc4cdf9deb6af760202bd5.jpg)

/dotdash_INV-final-Sell-Signal-Apr-2021-01-a114b66c6dbc4cdf9deb6af760202bd5.jpg)